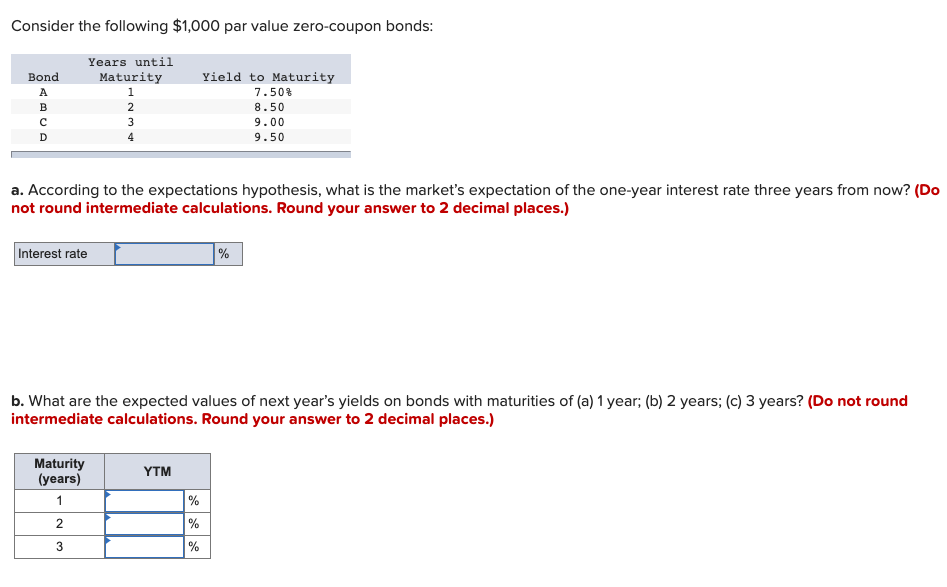

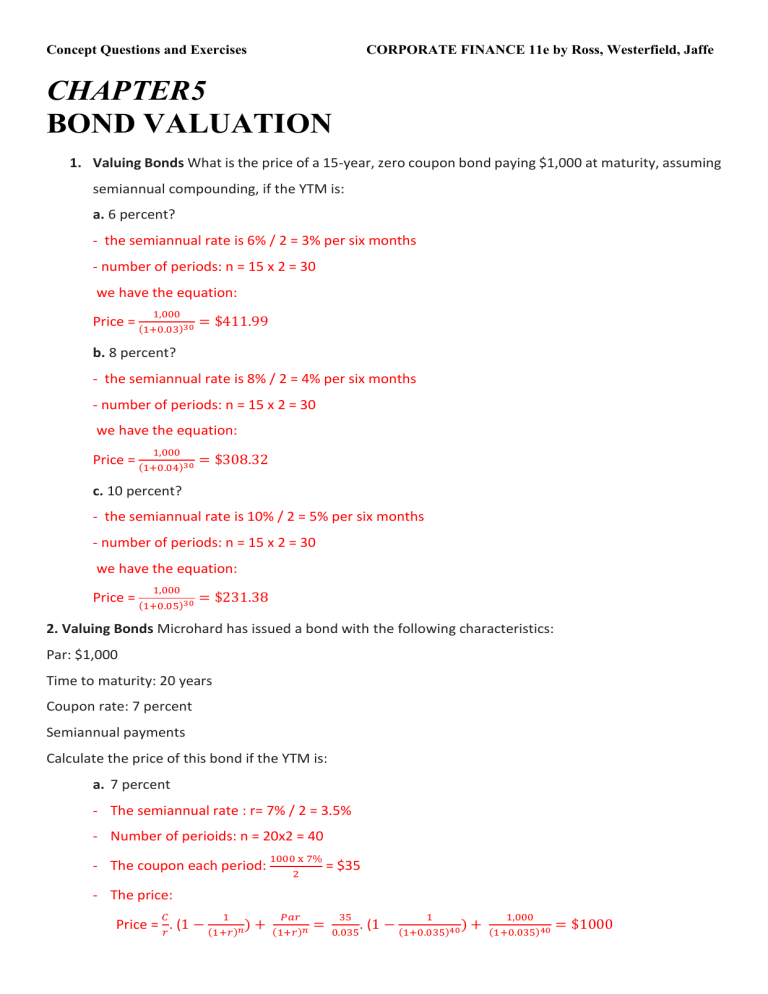

39 valuing zero coupon bonds

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Valuing zero coupon bonds

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The One-Minute Guide to Zero Coupon Bonds Oct 20, 2022 — With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For...

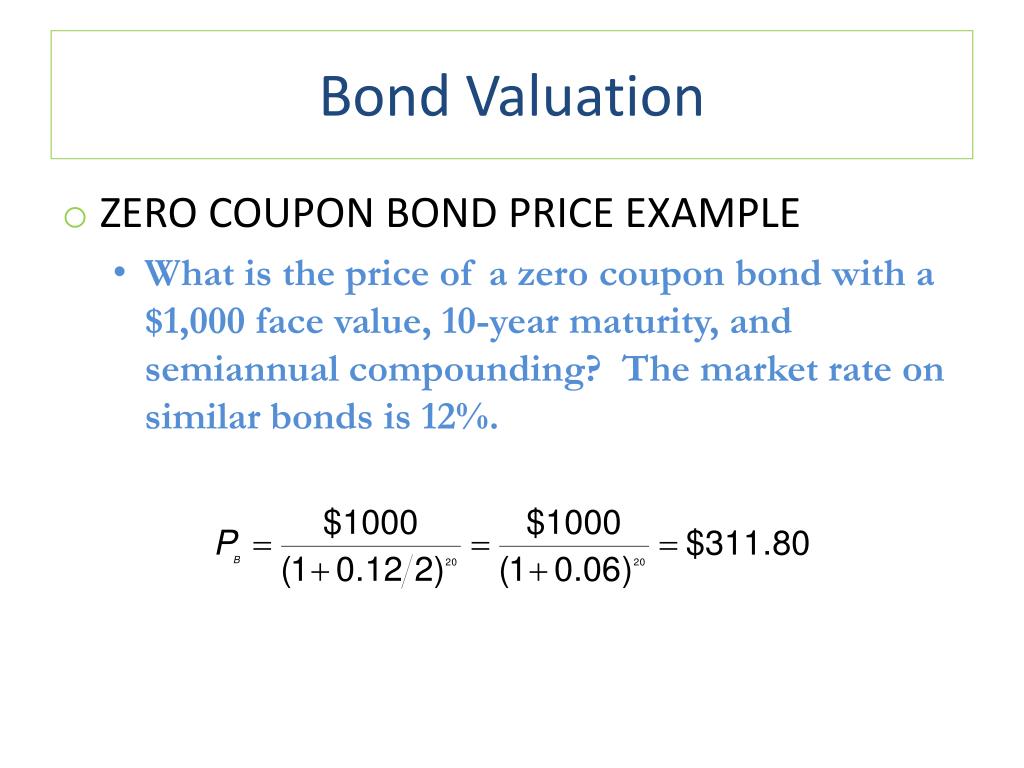

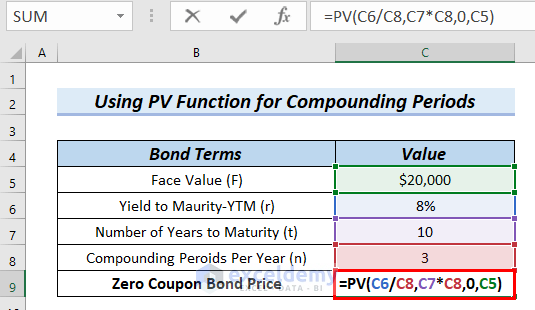

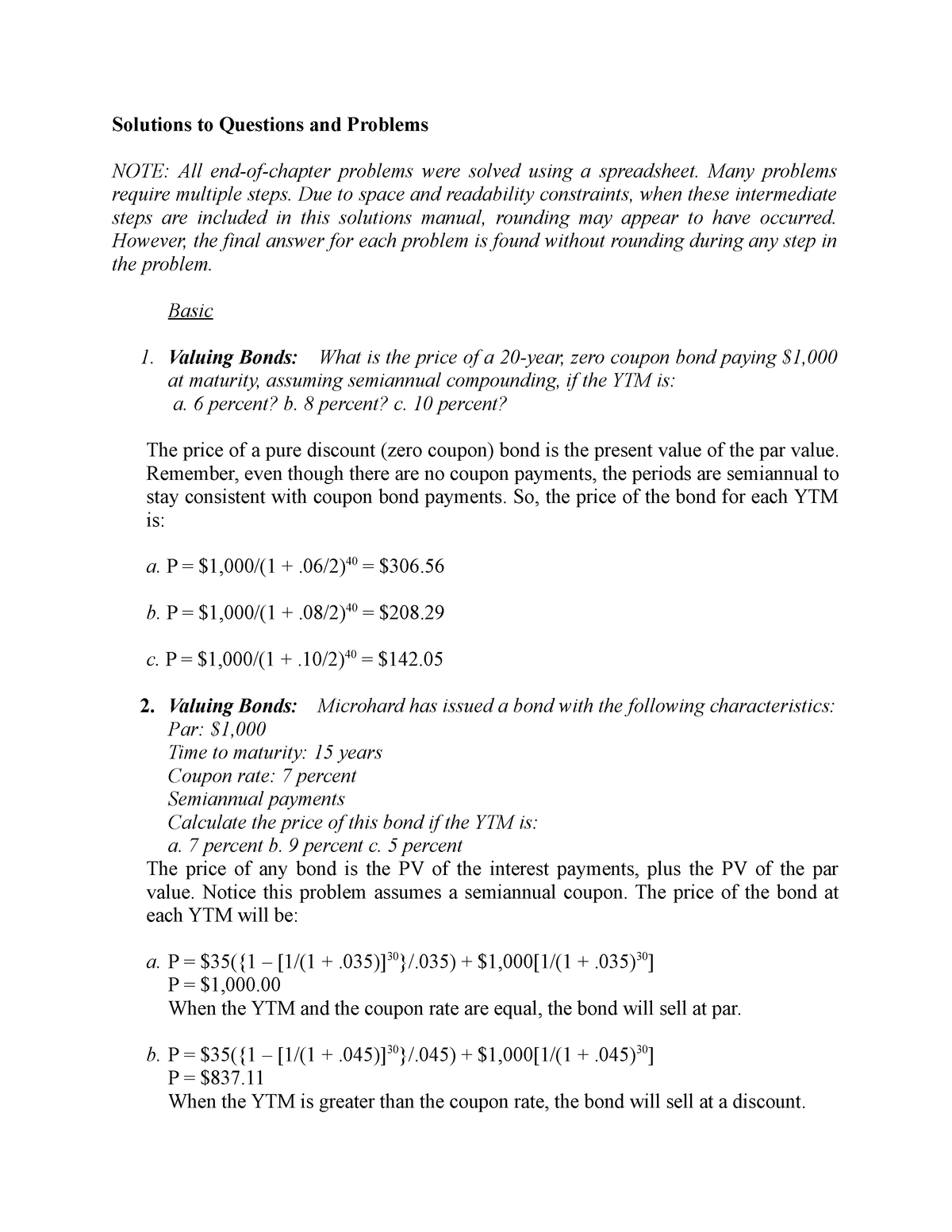

Valuing zero coupon bonds. Zero Coupon Bond: Definition, Features & Formula Zero-Coupon Bond Price Formula. When pricing a zero-coupon bond, you can use the following formula: PoB = FV / (1+r) n Where: PoB = Price of Bond. FV = Face value - the future value or maturity value of the bond. r = the required rate of return or interest rate. n = the number of years until maturity. The interest rate is assumed to be compounded annually in the formula above. Valuing a zero-coupon bond | Mastering Python for Finance - Packt A zero-coupon bond can be valued as follows: Here, y is the annually-compounded yield or rate of the bond, and t is the time remaining to the maturity of the bond. Let's take a look at an example of a five-year zero-coupon bond with a face value of $ 100. The yield is 5%, compounded annually. The price can be calculated as follows: Zero Coupon Bond | Investor.gov Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Bond Valuation: Calculation, Definition, Formula, and Example Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

Valuing a zero-coupon bond | Mastering Python for Finance - Packt Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, and is the time remaining to the maturity of the bond. Let's take a look at an example of a 5-year zero-coupon bond with a face value of $100. The yield is 5 percent, compounded annually. What Is a Zero-Coupon Bond? - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until... Zero Coupon Bond | Definition, Formula & Examples Feb 18, 2022 — The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value ... Zero Coupon Bond Calculator - What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

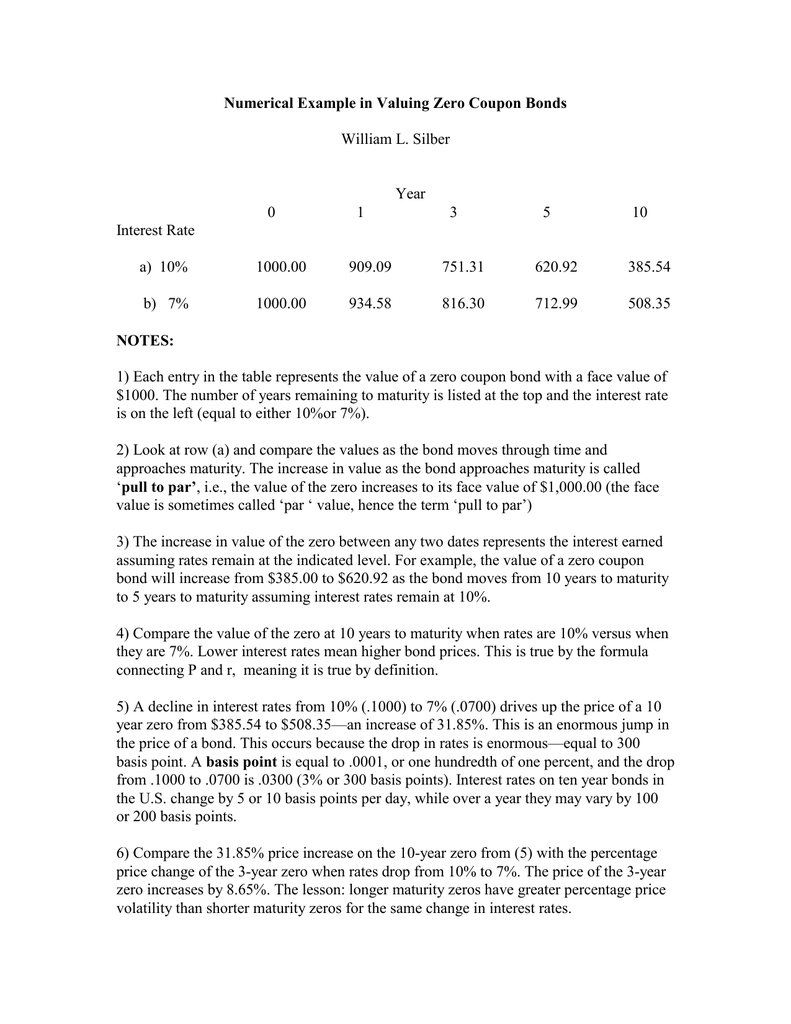

Zero Coupon Bonds Explained (With Examples) - Fervent The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. What is the price of this bond today, if the yield is 7%? Valuation of Zero-Coupon Bonds - YouTube This video provides an explanation of a zero-coupon bond and proceeds to show how the value and yield are calculated using manual computations as well as with financial calculator (BA II... Solved 2. Valuing a Zero-Coupon Bond. Assume the following - Chegg Question: 2. Valuing a Zero-Coupon Bond. Assume the following information for existing zero-coupon bonds: Par value = $100,000 Maturity = 3 years Required rate of return by investors = 12% How much should investors be willing to pay for these bonds? ANSWER: PV of Bond = PV of Coupon Payments + PV of Principal $0 + 100,000 (PVIF-12% -3 ... How to Calculate Yield to Maturity of a Zero-Coupon Bond With no coupon payments on zero-coupon bonds, their value is entirely based on the current price compared to face value. As such, when interest rates are falling, prices are positioned to rise ...

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

Zero-Coupon Bonds: Characteristics and Calculation ... A Zero-Coupon Bond is priced at a discount to its face (par) value with no periodic interest payments from the date of issuance until maturity.

Valuing Zero-Coupon Bonds A zero-coupon bond is one that does not pay interest over the term of the bond. Instead, the entity will sell the bond at lower than face value. When the bond's term is over, the issuing business will repay the bond at its face value. The bondholder generates a return paying less than what he receives in payment at the end of the bond's term.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For...

The One-Minute Guide to Zero Coupon Bonds Oct 20, 2022 — With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "39 valuing zero coupon bonds"