42 zero coupon bond accrued interest

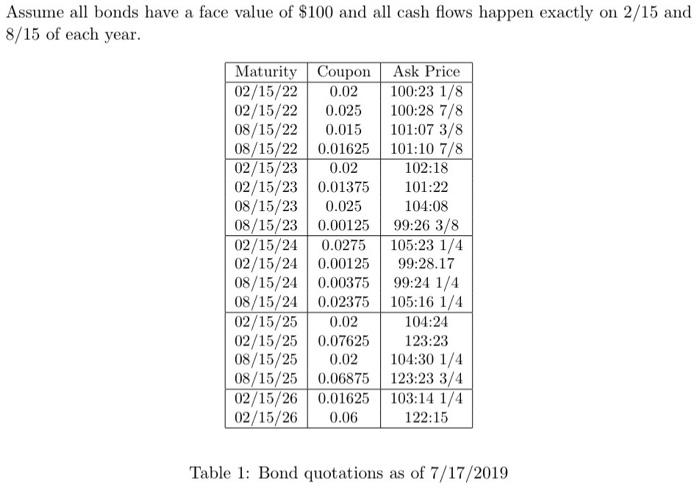

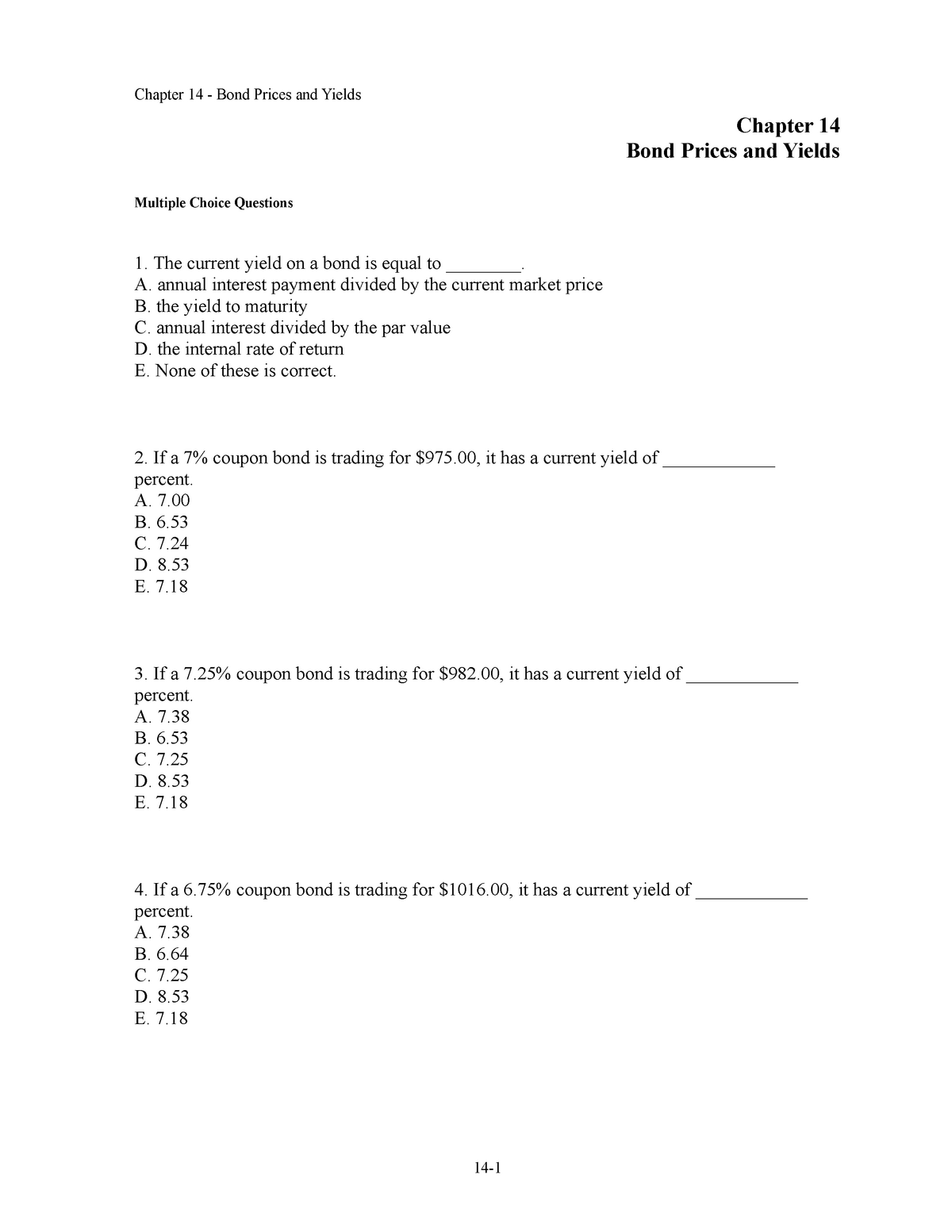

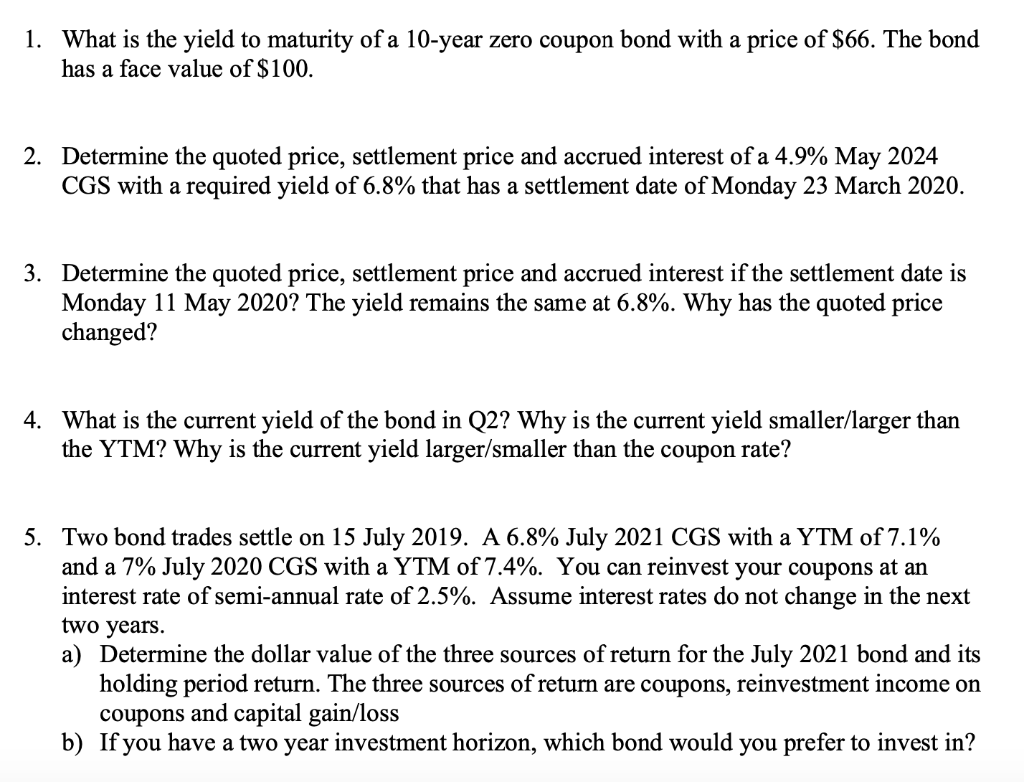

en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia The market price of a bond may be quoted including the accrued interest since the last coupon date. (Some bond markets include accrued interest in the trading price and others add it on separately when settlement is made.) The price including accrued interest is known as the "full" or "dirty price". (See also Accrual bond.) The price excluding ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

Bond Pricing and Accrued Interest, Illustrated with Examples A bond pays interest either periodically or, in the case of zero coupon bonds, at maturity. Therefore, the value of the bond = the sum of the present value of all future payments — hence, it is the present value of an annuity, which is a series of periodic payments.The present value is calculated using the prevailing market interest rate for the term and risk profile of the bond, which may ...

Zero coupon bond accrued interest

Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. › knowledge › zero-coupon-bondWhat are Zero-Coupon Bonds? (Characteristics and Examples) Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the face value and price of the bond could be thought of as the interest earned. assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

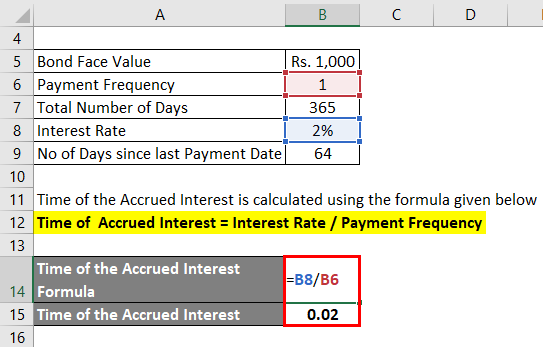

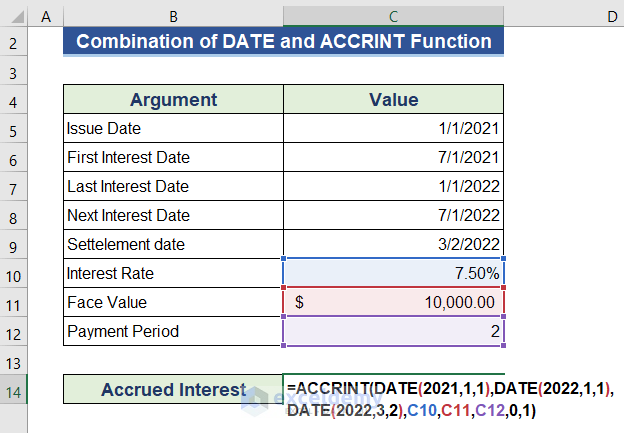

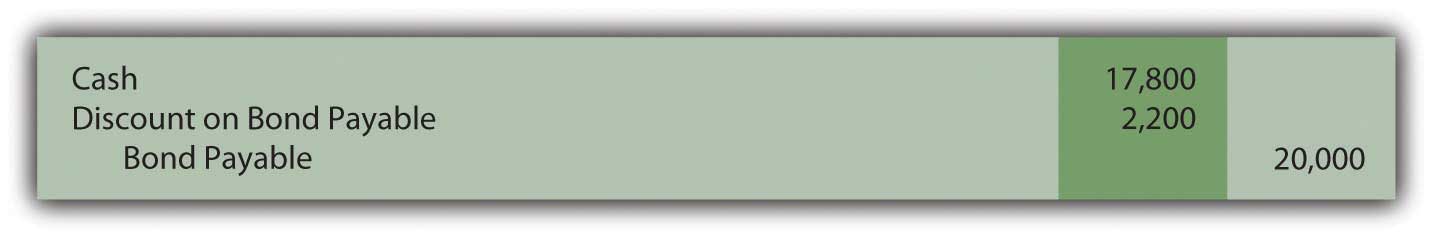

Zero coupon bond accrued interest. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If issued by a government entity, the interest generated by a zero-coupon bond is often exempt from federal income tax, and usually from state and local income taxes too. Various local... 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate 3. The compounding of this interest raises the principal by $1,068 from $17,800 to $18,868. The balances to be reported in the financial statements at the end of Year One are as follows: Year One—Interest Expense (Income Statement) $1,068. Accrued Interest and the Bond Market - Investopedia In this case, the bond would be $50 over the entire year ($1,000 x 5%), and investor A held the bond for 90 days which is a quarter of the recorded year, or 25% (calculated by 90/360). So, the... Accrued Interest - Overview and Examples in Accounting and Bonds Accrued Interest in Bonds - Example. For example, a Treasury bond with a $1,000 par value has a coupon rate of 6% paid semi-annually. The bond matures in two years, and the market interest rate is 4%. The last coupon payment was made on March 31, and the next payment will be on September 30, which gives a period of 183 days.

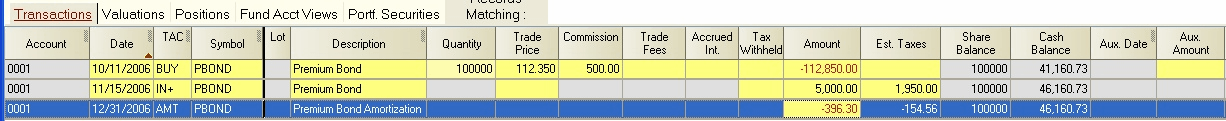

Zero coupon Bonds — Quicken Interest is earned on the bond and is paid at maturity when the bond is reddened at face value. To record this in quicken requires 3 transactions; 1) An Interest Income transaction - for the amount of interest, 2) A negative Return Of Capital - negative the amount of interest earned. 3] a Sell transaction at face value. Accrual Bond Definition - Investopedia An accrual bond defers periodic interest payments usually until maturity, much like a zero coupon bond, except the coupon rate is fixed to the principal value. Accrual bond interest is added to the... › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond The IRS mandates a zero-coupon bondholder owes income tax that has accrued each year, even though the bondholder does not actually receive the cash until maturity. 1 This is called imputed interest... › annuities › deferredAccrued Interest | What It Is and How It's Calculated For example, a zero-coupon bond maturing in 10 years and paying 4 percent interest would sell for approximately $6,755. Over the course of the next 10 years, the remaining $3,245 would accrue gradually until the bond matured, at which time the investor would be paid the full $10,000.

› publications › p1212Publication 1212 (01/2022), Guide to Original Issue Discount ... The coupon bond method, described in the following discussion, applies if the debt instrument is issued at par (as determined under Regulations section 1.1275-7(d)(2)(i)), all stated interest payable on the debt instrument is qualified stated interest, and the coupons have not been stripped from the debt instrument. This method applies to TIPS ... Zero Coupon Municipal Bonds: Tax Treatment - TheStreet Using the earlier example, if you paid $500 for a 10-year, $1,000 bond getting an interest rate of 7.05%, you would accrue $35.25 of interest in the first year. $500 x 0.0705 = $35.25. Your ... Calculate Accrued Interest Zero Coupon Bond Calculate Accrued Interest Zero Coupon Bond. 4 seconds ago. 0 0 Less than a minute. calculate zero coupon bond accrued interest ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

› knowledge › zero-coupon-bondWhat are Zero-Coupon Bonds? (Characteristics and Examples) Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the face value and price of the bond could be thought of as the interest earned.

Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Post a Comment for "42 zero coupon bond accrued interest"