42 coupon rate and yield to maturity

Solved Suppose a ten-year, bond with an coupon rate and - Chegg 83% (6 ratings) Transcribed image text: Homework: Assignment 6 (Chapter 6) Score: 0 of 1 pt 1 8 of 10 (6 complete) P 6-12 (similar to) Suppose a ten-year $1,000 bond with an 8.3% coupon rate and semiannual coupons is trading for $1,034.89. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Coupon rate is expressed as the percentage (per annum basis) of the face value of the bond. It is the amount that the bondholders will receive for holding the bond. Coupon payments are usually made semi-annually or quarterly. Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming ...

Coupon rate and yield to maturity

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity vs. Coupon Rate. The YTM and the coupon rate are two critical factors that investors should examine when thinking about purchasing bonds. Bonds of investment quality are low-risk investments that typically provide a return that is just a little bit higher than that of a typical savings account. ... Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion, 1. What is the yield to maturity (discount rate) on a | Chegg.com Business. Finance. Finance questions and answers. 1. What is the yield to maturity (discount rate) on a government bond being issued today with a $1,000 face value, $30 coupon, 5yr maturity, and being priced today at $923? Question: 1. What is the yield to maturity (discount rate) on a government bond being issued today with a $1,000 face value ...

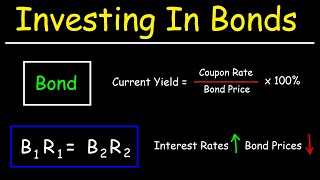

Coupon rate and yield to maturity. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than... Bond's Price, Coupon Rate, Maturity | CFA Level 1 - AnalystPrep Relationships Among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate. 27 Sep 2019. Price versus Market Discount Rate (Yield-to-maturity) The price of a fixed-rate bond will fluctuate whenever the market discount rate changes. This relationship could be summarized as follows: Yield to Maturity Calculator | Calculate YTM Determine the annual coupon rate and the coupon frequency; coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. PDF Yield-to-Maturity and the Reinvestment of Coupon Payments that in order to earn the yield to maturity on a coupon bond an investor must reinvest the coupon payments. We identify a ... She goes on to specify that the "coupons are reinvested at an interest rate equal to the yield-to-maturity." (Thau 2002, p. 25). Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Yield to Maturity Questions and Answers | Homework.Study.com The yield to maturity (YTM) on 1-year zero-coupon bonds is 5% and the YTM on 2-year zeros is 6%. The yield to maturity on 2-year-maturity coupon bonds with coupon rates of 12% (paid annually) is 5.... View Answer. There is a 5.8 percent coupon bond with eleven years to maturity and a current price of $1,059.80.

Difference Between Yield to Maturity and Coupon Rate The coupon rate is 5.25% with a term to maturity of 4.5 years. Yield to Maturity is calculated as, Yield to Maturity = 5.25 + (100-102.50/4.5) / (100+102.50/2) = 4.63%, Yield to Maturity can be identified as an important yardstick for an investor to understand the amount of return a bond will generate at the end of the maturity period. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond. In this article, we're going to talk about how to calculate the On the other hand, the spot rate is the theoretical yield of a zero coupon fixed-rate instrument, such as a Treasury Bill. Spot rates are used to determine the shape of the yield curve and for forecasting forward rates, or. This is equal to the Row 1 Carrying Amount times half the Yield to Maturity. In the example, the yield is 7.8891

How to Calculate the Price of Coupon Bond? - WallStreetMojo Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as,

Yield to Maturity Calculator In case a bond's coupon rate < YTM, THEN the bond is selling at a discount. Example of a calculation, Let's assume a bond with the following characteristics: - face value = $100,000, - current clean price = $140,000, - yearly coupon payment = $10,000, - years to maturity = 10. Will result in a YTM of 5%. 16 Feb, 2015,

Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula, The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3,

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2, The Yield to Maturity (YTM) of the bond is 24.781%, After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming you hold the bond to maturity, you will receive 12 coupon payments of $125 each, or a total of $1,500.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic,

write down the formula that is used to calculate the yield to maturity on a twenty year 12 coupon bo

Corporate Bonds - Price, Face Value, Maturity, Coupon Rate and Yield to ... Yield to maturity is a widely used measure to compare bonds. This is the annual return on the bond if held to maturity taking into account when you bought the bond and what you paid for it. A bond often trades at a premium or discount to its face value. This can happen when market interest rates rise or fall relative to the bond's coupon rate.

Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%.

1. What is the yield to maturity (discount rate) on a | Chegg.com Business. Finance. Finance questions and answers. 1. What is the yield to maturity (discount rate) on a government bond being issued today with a $1,000 face value, $30 coupon, 5yr maturity, and being priced today at $923? Question: 1. What is the yield to maturity (discount rate) on a government bond being issued today with a $1,000 face value ...

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion,

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity vs. Coupon Rate. The YTM and the coupon rate are two critical factors that investors should examine when thinking about purchasing bonds. Bonds of investment quality are low-risk investments that typically provide a return that is just a little bit higher than that of a typical savings account. ...

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "42 coupon rate and yield to maturity"